When Republicans say that President Obama is promoting class warfare with his tax proposals and so-called attacks on corporations, four points come to mind.

First, the “class warfare” charge is just so much political hogwash and pseudo-reality.

Second, about corporations: Are they really, as Mitt Romney and Justice John Roberts put it, “people too?” Third: The next bubble to burst might well be the student loan bubble — more accurately, “the indentured servitude” bubble.

Point four? You want to watch “pseudo” turn into “reality”? Just sit back and do nothing about the prospect of Point 3.

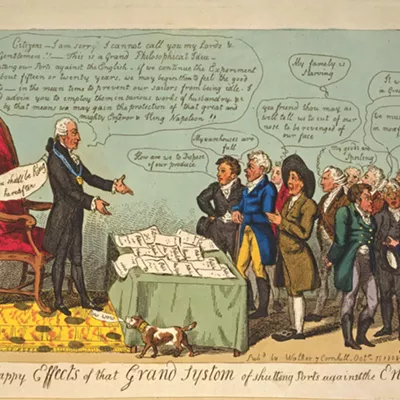

But back to that class-warfare hogwash: A modest rise in the highest marginal tax rates is class warfare? Come on! The French Revolution — now that was class warfare.

It all brings to mind the exchange Senator Pat Moynihan had with the senator who rose to call America’s tax code a “disgrace to mankind.” Never at a loss for the perfect rejoinder, Moynihan answered: “The Ethiopian famine is a disgrace to mankind; our tax code is about average for mankind.”

Taking America back to the Clinton-era tax rates hardly qualifies as class warfare; probably it’s about average for mankind.

But don’t take my word for it. Here’s what Seventh Circuit Appeals Court Justice and University of Chicago lecturer Judge Richard Posner (nominated by Ronald Reagan) wrote in anticipation of Obama’s proposed tax increases:

“Federal tax rates are lower today than they were in the 1940s, 1950s and 1960s — periods of healthy economic growth. The top marginal income tax rate reached 94 percent in 1945 and did not decline to 70 percent until 1965 [it is 35 percent today]. A modest increase in marginal rates from their present low level would increase tax revenues substantially, probably with little offset due to the distortions that any tax produces. And it would reduce executive overcompensation, which I have argued is one of the practices that helped precipitate the financial crisis.”

Surely, if lower tax rates on the highest incomes really did produce jobs as promised, the Bush years would have been boom years for job creation; instead, America experienced the lowest job creation in decades.

Which takes us to Point 3: the student loan default problem. Students are leaving college deeper in debt than ever before.

Before, they could find a career ladder to climb onto. Today, they can’t — those jobs are drying up. They leave college indentured in more ways than just that next unpaid internship.

Parenthetically, while public universities show rising default rates now in the 7.5 percent range, and private schools also report rising but significantly lower rates (in the 5 percent range), where the default rates really go off the charts is in proprietary schools — the “free marketplace” schools. These make-a-buck schools report average default rates of upwards of 15 percent, double the public and not-for-profit schools. The truth of the matter? The public is subsidizing for-profit schools, which, were it not for student loans, would see their enrollments tank. Talk about corporate America feeding at the public trough.

Of course, the Congress, which has known about this scam for decades, should do something. But that would call for questioning the private marketplace, and we know how that line of inquiry plays today. Message? Don’t count on this Congress, certainly the House of Representatives, to do anything contrary to its officially approved dogma of du jour.

Back to Planet Earth and Point 3, here’s the catch: Students, unlike businesses and homeowners, aren’t permitted to just walk away from these debts. Yup, by act of Congress, students can’t even file for bankruptcy. They can only default, which ruins their credit ratings for a long time; which then results in longer-term personal financial stress, exacerbating their already dim long-term career prospects.

Which brings me back to doing nothing about helping young people who are trying to enter the workplace, with their dearly earned college degrees in hand. By doing nothing, we’re enabling a new brand of indentured servitude — and keeping the American Dream out of reach for too many.

Mitt Romney’s line about corporations being people, too, has a nugget of truth to it. The middle class today is heavily invested in corporations. Pensions and IRAs have come to make up a huge part of the overall Wall Street market. Back in the late 1920s, it was different; relatively few people owned stock or had a direct interest in the market. Today, because of those pensions and IRAs, the percentage is much higher. Just a few years ago, three-fourths of the American public was invested in corporate America. So, in a way, yes, corporations are people — from retired teachers to retired police officers to retired executives.

But this percentage has been dropping. Like a rock. It has fallen to the mid-50s, down almost 20 points. No surprise. Fewer and fewer employers are contributing to retirement programs. This percentage would seem to be on a long-term downward trend. As fewer and fewer people have any stake in how the market does, tolerance for extravagant executive salaries and bonuses and outsourcing can be expected to rise as well.

As will support for tax increases. The plight of the under-30 demographic serves as the canary in the mineshaft. Obama, only through pale rhetoric, has addressed the dismal prospect of a lost generation — a generation that will have little or no stake in the future health of corporate America as it is now doing business. Meanwhile, Congress simply ignores them.

Many in that generation are bound to become unemployed or underemployed, in debt, and dealing with a constricted safety net when they need help.

Class warfare? This is the recipe for real class warfare.